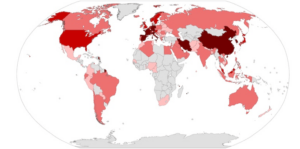

The impact of COVID-19 has been felt worldwide, with travel restrictions and mandatory stay at home orders, the world has had to figure out how to adapt to a new normal. Many businesses have been forced to close and as of June 2020, 17.75 million Americans were left without a job. COVID-19 has been responsible for over a hundred thousand deaths in the United States and most states were forced to issue mandatory stay at home orders to prevent the spread of the virus.

The Effects of COVID-19 on the Hotel Industry

COVID-19 has essentially shut down the world and while most industries have been hit hard, the Hotel Industry has been especially impacted. The Hotel Industry is responsible for supporting 8.3 million employees in the United States. To give you an idea of how massive this industry is, prior to COVID-19, the U.S. economy profited from nearly $660 billion generated by the Hotel Industry alone. In 2019, 1.9 billion Americans traveled domestically and of that amount 80% traveled for leisure. The pandemic has forced most Americans to stay home and has had far-reaching effects on the Hospitality Industry.

With over 5 million Americans infected by the virus and countless others forced into quarantine, it has resulted in nearly 22 million people becoming unemployed since its onset in February 2020. Subsequently, the Hotel Industry which depends heavily on travel and tourism has experienced devastating effects. Since the pandemic began, the hotel industry has lost more than 46 billion in room revenue. And it has been projected that hotels stand to lose up to 50% of their revenue this year, as most in the Hospitality Industry could see occupancy levels fall below 20%. With such low occupancy levels predicted, hotels run the risk of closing their businesses. Hotel workers have been severely impacted as well and stand to lose 1.7 billion in earnings each week. The Bureau of Labor Statistics has reported that 4.8 million hospitality and leisure jobs have been lost as a result of the pandemic.

Congressional Relief Offers Economic Assistance to Small Businesses

The impact of COVID-19 has been devastating on an industry that is dependent on travel and in response to the economic crises, the Corona Aid Relief and Economic Security Act (CARES) was enacted by congress in March 2020. The CARES Act was enacted as a means of offering economic assistance to preserve jobs in industries that have been adversely impacted by Covid-19. The Act offers financial assistance to businesses in order to add relief during the economic crises caused by COVID-19.

Upgrade Your Hotel Technology!

The Paycheck Protection Program

Under the CARES Act, small business owners can take advantage of the Paycheck Protection Program (PPP) which offers funds that allow businesses to pay up to 8 weeks of payroll and benefits costs. The PPP funds can also be used to pay interest on mortgages, rent and utilities and up to $659 billions can be expended towards job retention. As of April 2020, small businesses with 500 or less employees are eligible to participate in the Paycheck Protection Program.

This program offers loans that are fully forgivable when utilized for payroll expenses, interest on mortgages, and rent and utilities. Businesses are also protected from any fees associated with the PPP loans. While the paycheck protection program offers assistance to small businesses, there are certain criteria that have to be met in order for these loans to be fully forgiven. Loan forgiveness is based on the employer maintaining or quickly rehiring employees while ensuring their safety. Loan forgiveness will also be affected if the number of full-time employees is reduced and if there are reductions in salaries and wages.

Main Street Lending Program

Another program established to assists businesses in need is the Main Street Lending Program. The program offers lending to small and medium sized businesses, as well as not for profits who were operating in good financial standing prior to the Covid-19 pandemic. Businesses can apply for loans through an eligible lender.

Industry Leaders are Calling For Additional Resources

The Hotel Industry is applauding the government for providing small businesses with resources that are desperately needed. Many in the industry are urging congress to do more, as the impact of COVID-19 has caused an unprecedent loss of revenue. 1 in 10 hotel rooms remain unoccupied and 2020 is on its way to becoming the worst year on record for hotel occupancy. The financial crisis affecting the hospitality industry has been forecasted to be worse than that of the great depression.

The American Hotel and Lodging Association (AHLA) is calling for additional resources to be poured into the hotel industry. The American Hotel and Lodging Association is requesting the following revisions:

- Provide additional liquidity for severely impacted businesses through a targeted extension of the Paycheck Protection Program (PPP).

- Establish a Commercial Mortgage Backed Securities (CMBS) market relief fund, with a specific focus on the hotel industry, as part of the Federal Reserve’s lending options.

- Make structural changes to the Main Street Lending Facility established under the CARES Act to ensure hotel companies can access the program.

- Include limited liability language to provide a limited safe harbor from exposure liability for hotels that reopen and follow proper public health guidance.

- Include targeted tax provisions that will benefit severely injured businesses and their employees, including tax credits for capital expenditures or expenses to meet the industry’s Safe Stay initiative; enhanced Employee Retention Credit (ERC); a temporary travel tax credit; exempting taxation on phantom income from loan modification forgiveness or cancelation; and allowing full deductibility of the food and entertainment business expense.

On the Brink of Collapse

The Hospitality Industry remains in dire need of assistance, as 4 out of 10 hotel employees are still unemployed. According to the American Hotel and Lodging Association, 36% of hotels had the ability to rehire only 50% of their staff. And millions of hotel employees are still struggling to find employment. Thousands of hotels remain on the brink of closing due to significantly low occupancy rates. Additionally, travel is at an all-time low and this has resulted in a massive loss of jobs and loss of revenue. Labor Day is a major holiday where many Americans make travel plans and it’s normally a booming time of the year for the hotel business. However, with the onset of Covid-19, many Americans are avoiding crowds and opting to stay local. As a result, only 14% of hotels are reserved for the holiday and hotel occupancy is down 65% during this Labor Day as compared to last year.

There is Hope

The Hotel Industry employs millions of employees and adds billions of dollars to the U.S. economy each year. The industry and its employees have been facing one of the most devasting financial crises in recent history and the statistics are staggering. However, there is hope in sight as many hotels are beginning to establish cleaning procedures that ensure the safety of their staff and guests. Occupancy levels have reach near 50% during mid-August and travelers while still weary of the pandemic, are regaining the confidence to travel. Contactless technology enables guests to check in and out digitally and allows them to use their mobile phones to enter their rooms. Options are also available that allow guests to place food orders and request assistance without ever coming in contact with hotel employees. 80% of travelers are in favor of hotels providing digital services and these contactless options will be the key to restoring customer confidence.